How to Use Working Capital Loans for Scaling

Every business dreams of growth — more customers, bigger orders, higher revenue. But growth doesn’t come for free. You need cash to hire, produce, ship, advertise, and keep operations moving. That’s where working capital loans often step in. They’re short-term lifelines designed to cover immediate costs. When used well, they can help you scale smart. But when used carelessly, they can trap you in a cycle of debt that’s hard to escape. So how do you use working capital loans to grow — without burning your future?

What Working Capital Loans Are — And What They’re Not

Working capital loans are designed to help businesses cover short-term operational expenses. Think payroll, rent, supplies, or inventory. They’re not meant for long-term investments like real estate or machinery. These loans fill the cash gaps that naturally appear between payables and receivables — especially when sales grow faster than your bank account.

Many businesses face this exact scenario when scaling. You land a big order. That’s good news. But now you need to buy more inventory, hire help, maybe pay for logistics up front. The customer will pay in 30 or 60 days. You can’t wait. A working capital loan gives you the cash to deliver — and grow. But it also creates an obligation. These loans are short-term. They usually come with faster repayment schedules and higher interest rates than traditional business loans. That’s the trade-off for speed and flexibility.

When Using Debt for Growth Makes Sense

Not all growth is the same. And not all borrowed money leads to success. Using a working capital loan for scaling only makes sense when your increased costs are tied directly to increased revenue. You should be able to point to a contract, a customer purchase order, or a seasonal surge — something concrete that shows the cash will flow back in. If you’re borrowing just to stay afloat or chase vague opportunities, you’re taking on risk without a clear path to return.

One smart move is to match the loan timeline to your revenue cycle. If you take out a 6-month loan, make sure the sales you’re funding will generate cash within that period. Avoid using short-term loans for long-term needs — it puts pressure on your cash flow and can lead to refinancing traps. Another smart move is borrowing less than you think you need. Over-borrowing might feel safe, but it can lead to unnecessary debt servicing and tighter margins when repayments start.

Common Traps When Scaling With Loans

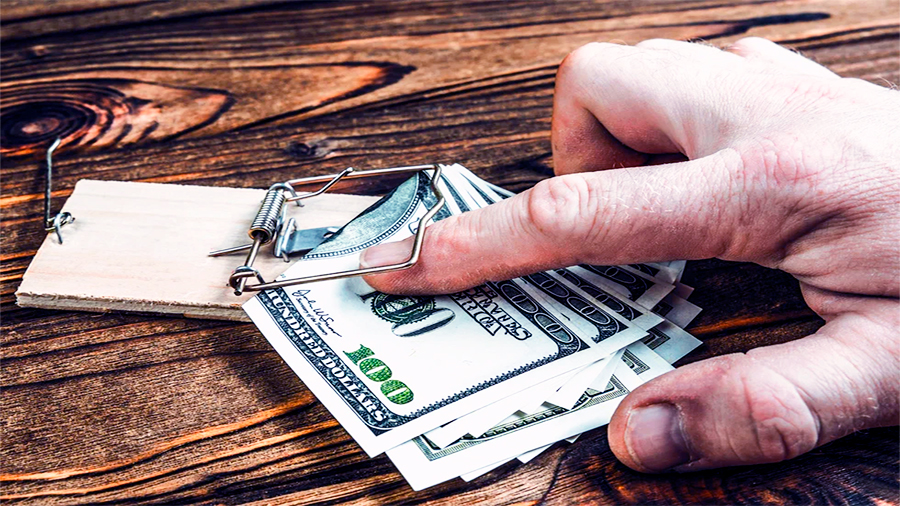

Fast growth can feel exciting, but it often hides warning signs. One of the biggest mistakes businesses make is assuming revenue growth will cover all their new expenses. It rarely does. You might hire too many people, invest in too much inventory, or expand into new markets before the first one is profitable. Suddenly your cash is gone — and the loan is still due.

Another common trap is stacking loans. You take one to fund a big order. It works. Then you take another to launch a new service. Then a third to cover marketing. Before long, you’re juggling multiple repayments, each with different interest rates and schedules. It becomes harder to tell whether the business is growing or just borrowing to survive. That kind of cycle is tough to break, especially if customers delay payments or margins shrink.

How to Plan for Growth With Borrowed Cash

Scaling with a working capital loan works best when it’s planned. That means knowing your numbers before applying. How much will you spend? How much will come back in? When? From whom? You don’t need a 50-page plan, but you do need clear answers to those questions. Cash flow forecasts, even basic ones, help you spot gaps before they become problems. The goal is to see whether the growth opportunity will pay for the loan — or if it’ll just lead to more debt.

Build in a cushion. Customers delay payments. Expenses run over. Something always goes wrong. Don’t bet everything on best-case scenarios. If your projections only work if everything goes perfectly, it’s time to rethink the plan. It’s also worth building a plan B: what happens if the revenue you expect doesn’t show up? Can you cover the loan? Will you need to slow hiring? Trim inventory? Having these decisions pre-made reduces stress if things get tight later.

Choosing the Right Loan Structure for Scaling

Not all working capital loans are equal. Some are revolving credit lines — you draw what you need, repay, and draw again. Others are term loans — you get a lump sum and pay it back on a fixed schedule. Revolving credit is useful for unpredictable costs or seasonal fluctuations. Term loans work better when you have a specific, time-limited need — like covering upfront costs for a new contract. Match the loan to your use case. Don’t use a 12-month product for a 3-week need.

Also watch the fine print. Many short-term loans include daily or weekly repayments, not monthly. That can put real strain on your cash flow if revenue doesn’t come in as quickly as expected. Some also include fees for early repayment or refinancing. Before you sign, run the numbers. Understand the real cost — not just the interest rate, but also any fees, penalties, and payment schedules. Cheap money isn’t cheap if it drains your account before you see any return.

Signs You’re Using the Loan Well

If your business grows steadily without a spike in stress, you’re probably using your loan correctly. If you can make repayments comfortably, if the extra cash helps you meet demand without cutting corners, and if your margins are healthy — that’s a good sign. You’re growing within your means, even if borrowed money helped you get there. That’s how short-term capital becomes long-term success.

But if you’re constantly waiting for payments just to cover yesterday’s costs, if you’re delaying payroll, or if new revenue is barely covering new debt — those are signs something’s off. You may need to slow down, restructure your loan, or scale back the plan. Growth isn’t always linear. Sometimes staying steady for a season is smarter than pushing forward with borrowed cash you can’t afford to repay.

How to Exit the Loan With Stronger Foundations

The goal with any working capital loan should be clear: get in, grow wisely, and get out stronger. That means using the borrowed funds to reach the next level — more orders, new customers, better infrastructure — and then transitioning to more stable financing if needed. If your growth is sustainable, future funding should be cheaper and easier to access. You can build credit history, show lenders you manage debt well, and eventually shift from short-term survival loans to long-term strategic capital.

Just don’t confuse debt with success. A business can look busy but still be running on fumes. What matters most is how well your growth turns into lasting, profitable operations. When a working capital loan helps you do that — it’s a tool, not a crutch.

The Conclusion

Working capital loans can be powerful tools for scaling, but only when used with discipline and foresight. Borrowing to grow is not the same as growing successfully. If the cash is tied to clear revenue, if the repayment fits your cycle, and if the plan holds up under stress, a short-term loan can unlock real momentum. But if you’re chasing growth without a plan, borrowing can become a burden. Use credit to move forward — not to cover up gaps. When scaling is smart, cash works harder. And growth becomes sustainable.

I’m Ethan Miller, a finance enthusiast and writer dedicated to breaking down complex credit and lending topics. My goal is to provide clear, honest insights that help you make smarter financial decisions with confidence and ease.

I’m Ethan Miller, a finance enthusiast and writer dedicated to breaking down complex credit and lending topics. My goal is to provide clear, honest insights that help you make smarter financial decisions with confidence and ease.